Uniswap v3: Revolutionizing Automated Market Makers

Written on

Chapter 1: Introduction to Uniswap v3

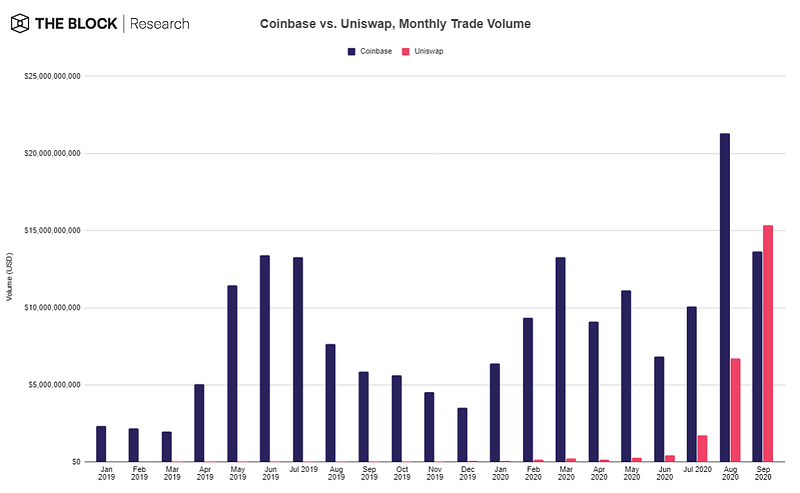

Uniswap has established itself as a pivotal player in the DeFi landscape, consistently appearing among the top 10 cryptocurrency projects by market capitalization. Remarkably, its trading volume surpassed that of Coinbase last September, achieving $15.4 billion against Coinbase's $13.6 billion.

Launched in November 2018, Uniswap initially functioned as a straightforward decentralized exchange (DEX), allowing users to trade ERC20 tokens directly on the Ethereum network without relying on centralized platforms like Binance or Coinbase. The introduction of v2 in May 2020 added ERC20-ERC20 liquidity pools, propelling significant growth with over $135 billion in trading volume and inspiring the development of related platforms such as SushiSwap and PancakeSwap.

On March 23, 2021, the Uniswap team unveiled the whitepaper for v3, outlining plans for its Layer 1 Ethereum mainnet debut on May 5 and subsequent deployment on Optimism. At its core, Uniswap v3 introduces two groundbreaking concepts: concentrated liquidity and multiple fee tiers. These innovations not only offer liquidity providers (LPs) greater flexibility but also enhance capital efficiency by up to 4000 times compared to previous versions. In the following sections, we will delve into the mechanisms of liquidity pools, impermanent loss, and automated market makers (AMMs) before exploring how v3 addresses the limitations of v2.

Section 1.1: Understanding Liquidity Pools

Liquidity pools in DeFi consist of reserves of crypto assets pooled and secured through smart contracts to ensure high liquidity and rapid trade execution on DEXs. This concept was first introduced by Bancor and later refined by Uniswap, along with other projects like Curve and Balancer, to achieve greater efficiency.

But why are these pools essential in DeFi? The answer lies in the difficulties faced by market makers when operating within a decentralized framework.

Section 1.2: The Role of Market Makers

In traditional finance, centralized exchanges utilize an order book model to match buyers and sellers. A transaction occurs when both parties reach an agreement on price. However, the likelihood of a buyer's bid perfectly aligning with a seller's ask at the same moment is minimal. Market makers bridge this gap, providing liquidity in exchange for profits generated from the spread between buy and sell orders.

To illustrate, consider the stock market: if buyers aim to purchase shares at an average of $99 each, while sellers prefer to sell at $100, a market maker can facilitate this transaction, fulfilling buy orders at $99 and later selling at $100, netting a profit from the spread.

However, in DeFi, this model encounters challenges primarily due to Ethereum's current transaction limitations and the associated gas fees. Market makers may struggle to adjust their orders quickly enough in response to volatile crypto prices, risking incurring more in gas fees than they can earn from the spread.

Section 1.3: The Automated Market Maker Model

In the DeFi ecosystem, liquidity pools are created by LPs who contribute two or more tokens of equivalent value. For example, in a USDC/ETH pool, LPs must provide USDC that matches the fair market value of ETH. In return, they receive LP tokens based on their contribution relative to the total liquidity in the pool. When a trade occurs within this pool, LP token holders earn a 0.3% fee proportional to their holdings.

Various DEXs employ slightly different algorithms, but the overarching mechanism is termed an automated market maker (AMM). Uniswap operates on a constant product market maker algorithm, which maintains a balance between token pairs through the equation:

(Token A) * (Token B) = Constant

For instance, if a user purchases ETH with USDC, the supply of ETH in the pool decreases while USDC supply increases, leading to a price adjustment in ETH relative to USDC.

To delve deeper into the AMM model, check out this video:

Chapter 2: Addressing Challenges with Uniswap v3

The introduction of Uniswap v3 addresses several limitations present in v2. Firstly, the concept of concentrated liquidity allows LPs to specify custom price ranges for their liquidity contributions, enhancing efficiency. For example, LPs can focus their capital on specific price brackets, thus improving their potential returns while minimizing risk.

LPs can now tailor their investments to match real market conditions, allowing for a more strategic approach to liquidity provision. Should prices fluctuate beyond their specified range, LPs could lose the ability to earn fees, and their assets may convert entirely to the less valuable token.

Moreover, Uniswap v3 introduces flexible fee structures with three distinct tiers: 0.05%, 0.30%, and 1.00%. These tiers reflect the varying levels of risk associated with providing liquidity to different trading pairs, enabling LPs to strategize effectively.

To understand more about setting up a Uniswap v3 position, watch this informative video:

Conclusion: The Future of DeFi with Uniswap v3

Uniswap v3's innovative features empower LPs to implement diverse strategies to maximize their returns while mitigating risks. The introduction of concentrated liquidity and multiple fee tiers positions Uniswap to compete with other AMMs while addressing the complexities that new LPs may face. As Uniswap expands onto Optimism, we can anticipate enhanced capital efficiency and reduced gas fees, paving the way for further growth within the DeFi space.

Disclaimer: This article is not intended as investment or financial advice. All opinions expressed here are solely my own.