Understanding Bitcoin Dominance: Its Significance in Crypto

Written on

Chapter 1: What is Bitcoin Dominance?

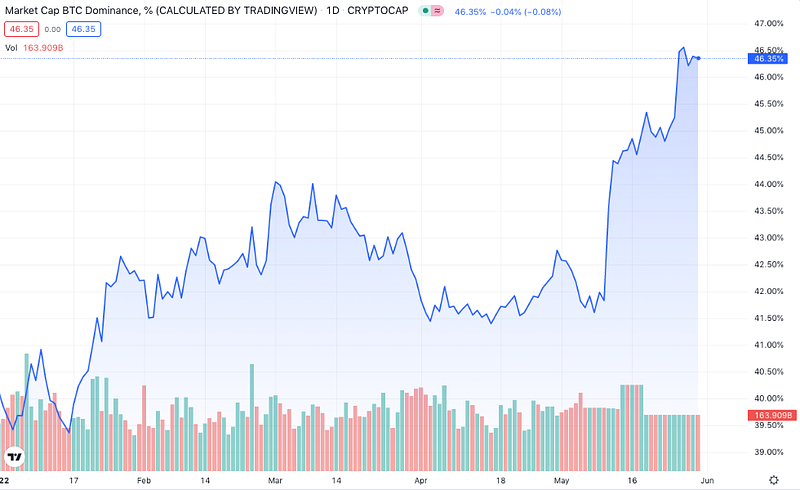

Bitcoin dominance, which recently reached a seven-month peak of approximately 46%, has been on the rise throughout the year despite the overall downturn in the cryptocurrency market. This metric gauges the proportion of Bitcoin's market capitalization relative to the total cryptocurrency market. While it's important not to place too much emphasis on this statistic alone, it serves as a vital indicator for anyone involved in cryptocurrencies. Simply put, Bitcoin's movements often dictate the broader market trends.

In times of market sell-offs or stagnant trading, Bitcoin generally performs better than many alternative coins. Conversely, during bullish phases, Bitcoin typically acts as the driving force behind the surges of altcoins. Thus, while Bitcoin dominance is only one of several metrics available, it provides a straightforward insight into the crypto landscape.

Section 1.1: Historical Context of Bitcoin Dominance

Initially, when Bitcoin was launched, it commanded nearly 100% of the cryptocurrency market, as there were no significant alternatives. Even after Ethereum's debut in 2015, Bitcoin maintained a dominance above 90% until the 2017 bull market, which allowed Ethereum and other altcoins to gain traction.

In 2017, Bitcoin's dominance saw a dramatic decline from 96% in February to around 37% by December's end. This shift occurred as investors flocked to Ethereum and other altcoins, marking a pivotal moment when Bitcoin was no longer the sole investment choice.

Section 1.2: The Impact of Market Cycles

By January 1, 2018, Bitcoin's dominance had reached its nadir shortly after achieving unprecedented price highs, nearing $20,000 for the first time. The surge in Bitcoin's price did not correlate with an increase in its dominance; instead, it coincided with a surge of new cryptocurrencies entering the market, captivating investor interest.

Fast forward to 2021, when Bitcoin hit its all-time high of nearly $69,000, and the scenario repeated itself. As Bitcoin attracted fresh capital, more investors turned their attention to other projects, leading to a decline in Bitcoin's dominance.

The video titled "Bitcoin Dominance" explores these fluctuations and their implications for the broader market.

Chapter 2: Bitcoin Dominance in Recent Trends

During bear markets, Bitcoin tends to regain dominance as investors see it as a safer asset. For instance, this year started with Bitcoin at around 40% dominance, which has since risen to 47%. This trend reflects a common pattern where money flows from riskier altcoins back into Bitcoin.

Long-term projections indicate that while Bitcoin may continue to lose market dominance as the cryptocurrency ecosystem evolves, this is a natural progression. Bitcoin’s early dominance was expected due to its pioneering role; however, the landscape has shifted with the introduction of numerous viable altcoins.

Even amid speculation that newer coins could replace Bitcoin, the market often corrects itself, leading to a resurgence in Bitcoin's dominance. Historically, after the 2017 bull market, Bitcoin saw its dominance stabilize between 60% and 70% before the next major surge.

Conclusion

As Bitcoin dominance rises toward yearly highs, its price hovers around $30,000, which has proven to be a critical support level. Recent fluctuations saw Bitcoin dip below $29,000 briefly, but it managed to rebound above $30,000.

Analysts, like those from JP Morgan, have suggested that a price around $38,000 could be considered "fair value" for Bitcoin. As the market consolidates, Bitcoin's price movements will likely influence its dominance further.

In conclusion, while Bitcoin's market share may diminish over time, it remains a foundational asset in the crypto space. Investors often return to Bitcoin when seeking stability, underscoring its ongoing relevance and resilience.