Unveiling DSR DeFi Secrets: Understanding and Preventing Rug Pulls

Written on

Chapter 1: The Shift from ICOs to DeFi

In 2017, Initial Coin Offerings (ICOs) dominated the cryptocurrency scene, often associated with scams. However, they have now largely been replaced by Decentralized Finance (DeFi) platforms. These fraudulent DeFi schemes operate on principles similar to Ponzi schemes, luring investors with promises of massive returns and excessive earning potential.

Those drawn in by the allure of quick profits often invest a sum of money, leading others to follow suit. As the total investment grows, the liquidity is quickly siphoned off, a deceitful act known as a "rug pull." Unfortunately, recovering even a small fraction of the lost liquidity is exceedingly challenging.

Here is a video that explains the concept of rug pulls in detail.

Another common fraudulent tactic within the DeFi space involves manipulating token prices to encourage purchases, ultimately locking investors into trading pairs on the platform. Fraudsters then sell off the tokens, leaving investors empty-handed and with no recourse as the platform disappears.

Section 1.1: Safeguarding Against Scams

So, how can investors protect themselves from these scams? There are various preventive measures that can help minimize the risk of losing funds. It’s crucial to conduct thorough due diligence before investing.

For starters, always check the Total Value Locked (TVL) and the promised rewards across different farms. Many platforms boast rewards in the thousands, but it’s vital to verify the actual funds allocated. Often, farms may have only a few dozen dollars in liquidity, and adding more coins can drastically reduce the promised returns.

Subsection 1.1.1: Key Contracts to Review

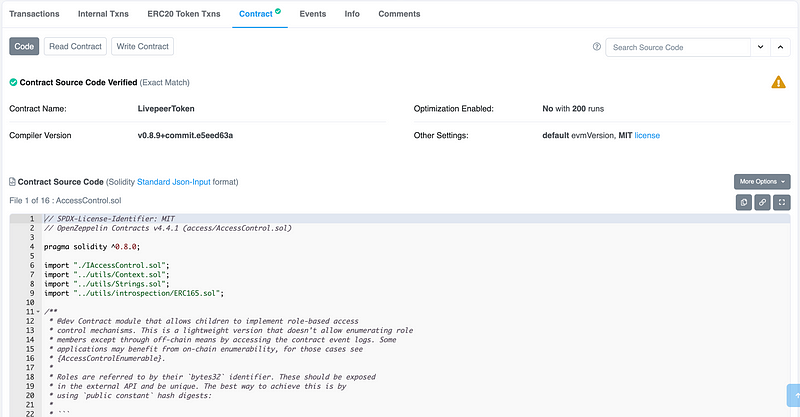

To ensure the legitimacy of a DeFi platform, one should look for three essential contracts: the token creation contract, the Masterchef contract, and the TimeLock contract. If any of these contracts are missing, it warrants further investigation, including checking for audits and their outcomes.

The verification process for smart contracts can typically be conducted on the Ethereum blockchain (for ERC-20 tokens), where a verified tick mark indicates legitimacy.

The Masterchef contract is particularly significant, as it oversees all farming activities on the platform. It manages the native token's smart contract, allowing users to identify any potential vulnerabilities or malicious commands within the code.

Section 1.2: The Importance of the TimeLock Contract

The TimeLock contract plays a crucial role in managing changes to the Masterchef contract. Any modifications cannot take effect immediately, offering users a safety net. For instance, if developers attempt to increase withdrawal fees dramatically, the TimeLock allows a grace period before those changes are enforced, giving users time to withdraw their funds at the previous rates.

Chapter 2: Utilizing Resources for Protection

As highlighted in this article, while DeFi poses certain risks related to scams, effective tools for protection are available. Before diving into new platforms, it’s advisable to visit rugdoc.io, which provides calendars for upcoming farms and a risk ranking for each project.

If you're new to trading, consider exploring crypto trading bots or copy trading strategies to ease into the market.