# Tax Season: Embrace the Growth Mindset and Stay Focused

Written on

Chapter 1: Understanding the Tax Landscape

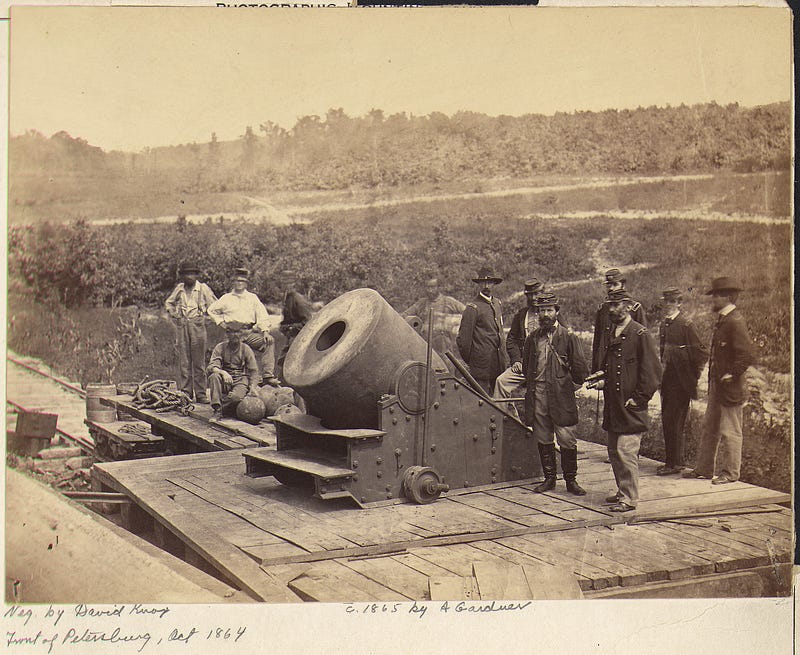

When preparing for a girls’ night in, think of the correct mindset for tackling your taxes! Federal annual income taxes (FAIT) were first introduced in 1861 as a temporary measure to help fund the American Civil War. However, what started as a short-term solution became a permanent fixture with the ratification of the Sixteenth Amendment in 1913, giving Congress the authority to tax all incomes.

Filing tax returns can be quite nerve-wracking—especially for those with investments, dependents, or property. If you’ve recently had a contentious divorce, you might find yourself procrastinating or trying to escape the realities of tax season through distractions.

You might believe there’s still time to focus on other activities instead of your tax responsibilities. Reflect on those guitar lessons you intended to take back in 2014 or that woodworking venture you’ve been postponing for months. It’s time to realign your priorities.

Tax Tip: Remember that W9 filers do not have tax withholdings. If you earn over $10, expect a 1099-MISC from Medium. Taxes are an unavoidable reality.

Shift your focus from personal distractions to understanding your Adjusted Gross Income (AGI). A growth mindset enables you to identify imbalances and streamline your processes.

Anger Management During Tax Season

It’s easy to feel frustrated when you think about taxation. After all, didn’t we rebel over unfair taxes back in 1773? While historical grievances are valid, it’s essential to channel that energy into preparing your tax documents.

Pro Tip: Dress appropriately at home to avoid distractions while searching for that misplaced 1099-MISC. Creating a designated storage space for tax-related documents can save you time and stress.

Once frustration subsides, feelings of unfairness may arise, leading to guilt over procrastination. You might find yourself envying wealthy individuals who can afford to hire professionals for tax preparation. Keep in mind that perfection isn’t necessary; you can always file a 1040-X within three years if needed.

Bargaining with Yourself

You might attempt to negotiate with yourself to avoid tackling your taxes. However, this often leads to disappointment as the deadline approaches. Ensure you’re prepared with all necessary documents before you begin the filing process.

Don’t let unhealthy habits interfere with your productivity. Establishing effective methods to stay focused is crucial for maintaining balance during this taxing time.

Myth-Busting: Contrary to popular belief, excessive indulgence won’t impair your vision. Instead, focus that energy into completing your tax forms. Remember, the best time to start was when tax season began; the next best time is now.

Acceptance of Your Responsibilities

You cannot change the tax laws, but you can change your approach to filing. Complete your taxes instead of letting stress overwhelm you. Once you’ve submitted your electronic return, you can then tackle the complexities of your financial situation.

Pro Tip: If you’re self-employed or a freelancer, look into tax deductions available for your filing status. Understanding these nuances can significantly impact your return.

Maintaining a healthy balance between personal well-being and fulfilling tax obligations is vital. Educating yourself about the U.S. tax system in creative ways helps promote a growth mindset. Remember, effective time management is essential for navigating your finite lifespan.

Need additional assistance? Explore the IRS’ Interactive Tax Assistant.

Victor Cardenas, while not a tax expert or mental health professional, offers insights that may resonate with you.

More of Victor's engaging works include:

- My ‘Hall Pass’ List

- Counterpoints: Follow For Follow

- Copulation Meets Aviation