Michael Burry's Insights on the Upcoming Stock Market Downturn

Written on

Chapter 1: The Shift in the Job Market

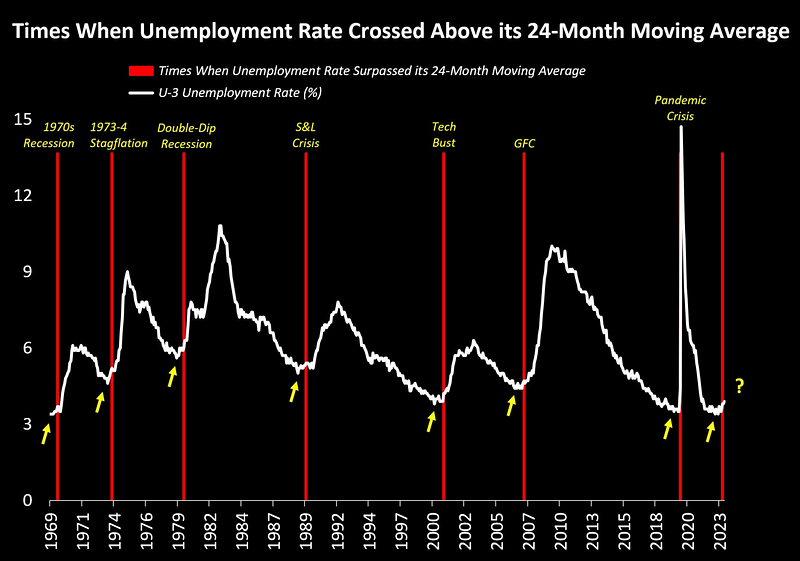

The U.S. job market is showing signs of change, a development often linked to the onset of a recession. Recent discussions have drawn comparisons between today’s conditions and those leading up to the 2008 financial crisis.

On May 19, 2005, Michael Burry anticipated the looming housing crisis by investing $60 million in credit default swaps from Deutsche Bank, strategically targeting six separate bonds with $10 million each. His insights were rooted in a thorough analysis of the U.S. mortgage-backed security market, which he recognized as increasingly vulnerable due to widespread greed and malpractice. Burry’s strategy was built on extensive research rather than mere conjecture.

Section 1.1: A Precursor to Crisis

The broader market did not begin to acknowledge the crisis until October 11, 2007, when the S&P 500 reached its zenith. By March 10, 2009, it had plummeted to a mere 676 points, marking a staggering 57% drop from its peak. This tumultuous market environment resulted in substantial gains for Burry, who personally earned $100 million while securing over $700 million for his investors. Despite this success, he faced significant backlash from both the investment community and his investors leading up to the crash, ultimately deciding to close his fund post-crisis.

Section 1.2: Current Economic Concerns

Burry has been vocal regarding the dangers posed by high inflation, a consequence of the Federal Reserve's substantial monetary easing. Initially, his predictions were considered unconventional; however, as inflation rates surged to 8.6%, his warnings have gained traction. He believes that the current economic downturn is merely in its initial phases, projecting a further 50% drop in the S&P 500.

Burry’s analysis indicates a trend where the nadir of a market crash is typically lower than its predecessor by approximately 10 to 15%. He forecasts that the S&P 500 could descend to around 1,862 points, reflecting a significant decline from current figures. Despite recent market rallies, Burry regards these as fleeting, positing that more substantial declines lie ahead. He highlights the relatively low trading volumes during this downturn, suggesting that considerable selling pressure is still imminent, which could precipitate steeper market declines.

Chapter 2: Consumer Financial Instability

Michael Burry's Warning For The Stock Market Crash: Most People Have No Idea What's Coming Next - This video elaborates on Burry's insights into the potential stock market crash, detailing the economic indicators he believes signal an imminent downturn.

Burry also raises alarms about the state of U.S. consumer finances, noting a decline in personal savings to levels not seen since 2008, alongside a spike in credit card debt, despite the influx of stimulus funds. This situation, according to him, could usher in a consumer recession, further adversely affecting corporate earnings.

Michael Burry's Warning For June 2024 Stock Market Crash: This New Crisis Will Terrify Everyone - In this video, Burry shares his latest thoughts on the impending crisis, drawing parallels with previous market downturns.

Burry’s perspective is informed by his experiences and observations of prior market cycles, including the dot-com bubble and the 2008 financial crisis. He identifies recurring patterns of human behavior in financial markets that often precede major economic downturns.

In conclusion

Michael Burry’s current outlook remains starkly pessimistic, predicting further economic hardships and declines in the stock market driven by inflation, rising interest rates, and dwindling consumer savings. His viewpoints, shaped by historical precedents and current economic signals, suggest a prudent approach to navigating the evolving financial landscape.