<Exploring Innovative Horizons in Life Sciences and Technology>

Written on

Axial collaborates with visionary founders and inventors, investing in nascent life sciences enterprises such as Appia Bio, Seranova Bio, and Think Bioscience, often in their conceptual stages. Our commitment lies in empowering the exceptional inventor determined to establish a lasting business. If you or someone you know has an innovative idea or company in life sciences, Axial is eager to connect and explore potential investment opportunities. Reach out to us at [email protected].

New frontiers #3

- ADCs

- Cultured meats

- Phenotypic screening

- Industrial enzymes

- Chemokines

- Developing a US counterpart to WuXi

- Infectious diseases

- Immunometabolism

- Rapid drug development

- Single-cell sequencing

As always, this list of companies is not exhaustive; some may be operating in stealth mode, making public discussion inappropriate. We prefer to avoid excessive logo usage.

ADCs

Antibody-drug conjugates (ADCs) uniquely merge the targeting ability of antibodies with the cytotoxic effects of conjugated agents. The three essential components of an ADC are:

- A monoclonal antibody, characterized by low immunogenicity, high affinity for specific cancer antigens, prolonged stability, and the capacity to internalize for agent delivery.

- A cytotoxic agent, typically designed to target DNA or microtubules for inducing cell death. Key features include conjugation compatibility, water solubility, and stability. Common agents include calicheamicins, auristatins, and maytansines.

- A chemical linker, arguably the ADC's most critical element, dictates pharmacokinetics and stability. It is essential that the linker only disassembles in particular environments to prevent damage to healthy tissue. Linkers can be classified as cleavable, activated by specific conditions, or non-cleavable, which depend on lysosomal degradation. For instance, Adcetris (Seattle Genetics) utilizes a cleavable linker sensitive to proteases, while Kadcyla (Genentech) employs a non-cleavable variant.

The ADC mechanism involves several steps:

- The ADC binds to an antigen via its antibody.

- The ADC/antigen complex enters the cell through endocytosis.

- The linker degrades; this occurs within the endosome for ADCs with cleavable linkers, while non-cleavable linkers release the agent following protein breakdown in the lysosome.

- The cytotoxic agent is released.

- Cellular apoptosis is initiated.

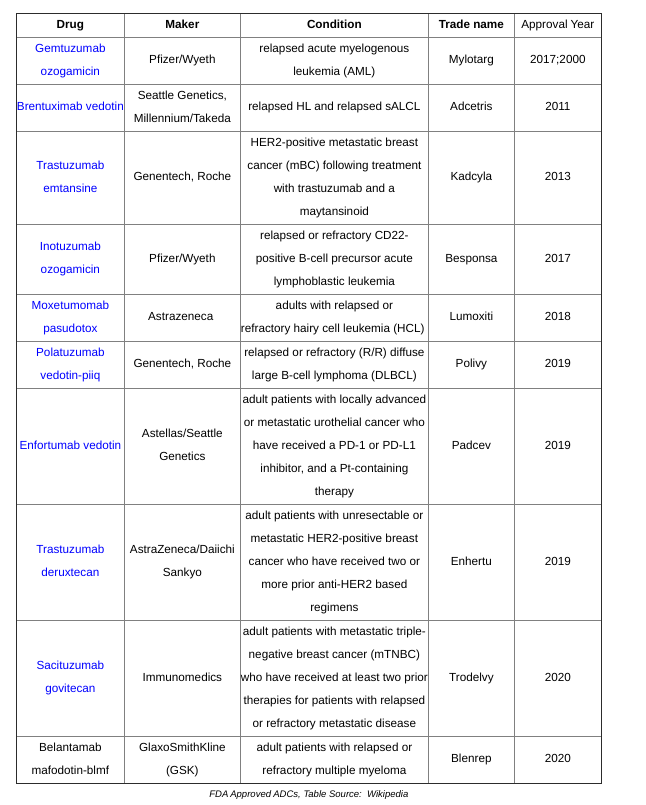

With 11 approved ADCs and over 80 clinical trials in progress, the field has recently accelerated, boasting three approvals in 2019, two in 2020, and one so far in 2021. The sector has rebounded significantly over the past two decades as companies have learned from earlier failures, developing novel linkers and chemistries to address toxicity issues posed by non-specific linkers. Many newly approved ADCs draw from the design principles established by Seattle Genetics’ Adcetris, which gained approval in 2011 for Hodgkin lymphoma and ALCL.

The four primary challenges facing ADCs include:

- Off-target effects, often due to inaccurate dosing.

- Limited tumor penetration.

- The potency of the cytotoxic agent.

- Stability challenges leading to shorter ADC half-lives.

ADCs can also be perceived as systemic chemotherapy. Their antibody specificity can enhance toxic selectivity for cancer cells. While promising data has been observed in model organisms, translation to humans has often faltered due to dosing issues. Improved linker designs can mitigate off-target effects and broaden the therapeutic window for ADCs in clinical trials. Key considerations for linker stability involve aligning the linker type (cleavable or non-cleavable) with the environmental conditions and selecting suitable conjugation sites on the antibody. Traditional sites on lysine and cysteine groups are based on their nucleophilic nature; however, engineered sites are emerging to create homogeneous populations of ADCs.

For effective solid tumor treatment, an ADC must achieve a lethal concentration of the cytotoxic agent across all cancer cells. Heterogeneous distribution can lead to resistance in certain tumor cells. A promising strategy is to attach helper proteins, like tissue-penetrating peptides, to the antibody. This design aspect can significantly increase costs. Selecting the appropriate cancer model and monitoring penetration are crucial for success.

Moreover, an ADC's drug-to-antibody ratio (DAR) and the cytotoxin's nature determine its potency. A higher DAR can enhance efficacy but may result in off-target effects if the linker lacks specificity. Hence, optimizing the relationship between linker and DAR is vital for an ADC's approval potential.

Ultimately, managing the hydrophobicity of the cytotoxic agent is crucial for ADC stability, as excessive hydrophobicity can lead to aggregation. Ensuring linker stability in the bloodstream is essential for minimizing off-target effects. The path to ADC success lies in holistic drug design rather than merely optimizing individual components. New opportunities in the field include:

- Innovating new linkers that react to specific environments and exploring alternative conjugation methods.

- Developing new penetrating agents for ADCs.

- Testing additional cytotoxic agents.

- Introducing new stability-enhancing moieties to the antibody.

Cultured Meats

Cultured meats leverage advancements in cell culture technologies for food production. The first cultured meat product, a beef burger, was introduced by the Post Lab at Maastricht University in 2013, costing around $300,000. This innovation led to the establishment of Mosa Meat and initiated the current surge in cultured meat development. Given the rise of plant-based meats and technological advancements, the cost of producing that initial burger has plummeted to $10-$20, opening doors to revolutionize the trillion-dollar meat industry encompassing beef, poultry, seafood, and pork.

By obtaining a biopsy from an animal, cells—often stem cells that can differentiate into muscle and fat—are cultivated in a nutrient-rich medium. Typically, fetal bovine serum (FBS) is used, derived from calf blood, underscoring the need for serum-free alternatives. During cultivation, over one trillion cells can be produced, forming complex structures influenced by scaffolding and mechanical stress.

This technology could yield significant impacts on the meat industry and the environment:

- Enhanced capability to optimize meat for superior nutrition.

- Production shifts from animals to cells, potentially reducing land and water usage while curtailing methane emissions. However, further research is necessary to clarify these environmental impacts, especially concerning the carbon footprint of fossil-fuel-powered incubators.

- Minimization of foodborne illnesses from pathogens like salmonella and E. coli, alongside a reduction in antibiotic use. However, risks associated with excessive hormone use during cultured meat cultivation remain.

- Restructuring the protein supply chain.

- Contributing to global food security amidst limitations on arable land.

The commercial success of plant-based and fungi-derived products, spearheaded by companies like Impossible Foods and Beyond Meat, positions cultured meat companies to capitalize on this growth and enhance consumer acceptance of alternative proteins. While current plant-based offerings are simpler to produce, they face limitations in texture, sensory experience, and taste. Cultured meats can address these challenges by creating entirely new products or hybridizing with plant-based options to improve realism.

The key factors driving product innovation and business growth in this sector include: (1) regulatory frameworks, (2) strategic partnerships, and (3) consumer acceptance. In 2018, the USDA and FDA introduced a collaborative regulatory framework for cultured meat, assigning the FDA oversight of early-stage development and the USDA managing processes closer to commercialization. Similar initiatives have emerged globally in regions like India, the EU, and Singapore, providing clarity for companies. Partnerships have enabled newcomers to access distribution channels and institutional knowledge; Tyson’s investment in Memphis Meats exemplifies this trend. However, more effort is needed for widespread consumer adoption, which hinges on achieving cost parity and matching the sensory profiles of traditional meat.

Scaling production and developing new business models are critical for the success of cultured meats. Establishing manufacturing processes capable of producing hundreds of thousands to millions of kilograms of meat at or near cost parity is essential. Furthermore, moving beyond vertical integration for alternative foods could expedite product development and establish industry standards:

- Creating contract development and manufacturing organizations (CDMOs) that cultured meat companies can utilize, circumventing the need for in-house production. Established companies may enter this space, though they currently hesitate due to lower profit margins compared to drug development. This effort could facilitate industrial-scale cultured meat production.

- Unlocking growth factors and standardizing growth media alongside bioreactors. Open-source business models present exciting opportunities in this area, including replacing FBS in large-scale production.

- Developing diverse cell lines with various growth characteristics and biobanking requirements.

- Innovating scaffolds that enable cultured meats to mimic the natural textures of meat fibers, connective tissues, blood vessels, and fat.

- Exploring new culturing techniques, such as oxygen perfusion and micronutrient enhancements.

- If vertical integration is no longer a necessity, cultured meat companies could license their products as meat items or ingredients.

Phenotypic Screening

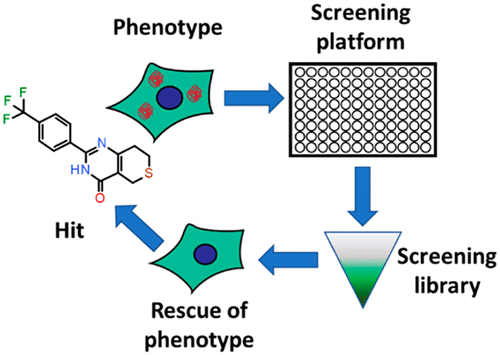

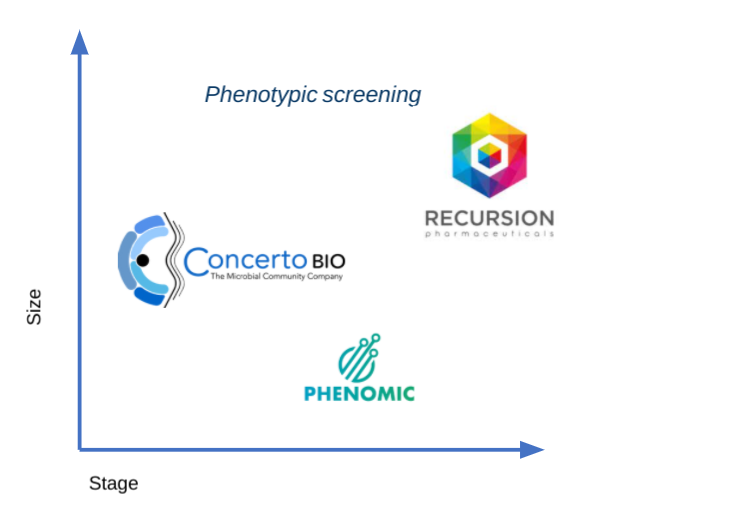

Drug discovery has its roots in natural products, focusing on identifying chemical entities that instigate biochemical changes or alterations in physical traits. Phenotypic screening emphasizes the identification of relevant phenotypes and rescues of interest. Despite advances in genomics and structure-based drug design, which have shifted the focus to specific targets or pathways, phenotypic screening remains valuable in contexts where biological mechanisms are not fully understood. This traditional method continues to address modern challenges and has potential beyond drug development, including transformative applications in consumer goods, as demonstrated by Revela.

In 2015, a Pfizer team outlined fundamental principles for effective phenotypic screening:

- Utilizing physiologically relevant cell types and models, such as iPSCs, organoids, and even animal models. In vitro models enable higher throughput compared to in vivo models, which may offer more accurate results. Parallel Bio is a frontrunner in this domain.

- Crafting assays relevant to specific diseases.

- Establishing assay endpoints that correlate with clinical outcomes, focusing on biomarkers or disease signatures that match clinical samples.

Phenotypic screening can be categorized into two primary phases: (1) simple primary assays designed to cover a broad range of chemical matter and (2) complex, physiologically relevant models to refine interesting hits. Once a model is established, an extensive library of molecules can be screened to monitor expression changes in a variety of proteins or cellular characteristics like proliferation. Secondary assays are predominantly used for counter-screening and filtering out compounds with general effects. While phenotypic screening tends to incur higher upfront costs compared to target-based programs, automation of high-throughput screening enhances this process, utilizing techniques like transcriptomics, proteomics, unsupervised machine learning, high-content imaging, and other tools within the assays. Hits are then categorized into mechanism classes to prioritize them, emphasizing target deconvolution. Although many approved drugs have been developed without a known target, this knowledge is crucial for mitigating program risks. Fortunately, advancements in a multitude of tools have made this information more accessible, including panels of known target classes and activity-based protein profiling, along with compound-immobilized beads, photoaffinity labeling, and cellular thermal shift assays.

In drug development, the primary objective is to formulate and test a hypothesis. In target-based discovery, the process involves testing a hypothesis (biological, clinical, commercial) by generating a hit for a specific target, followed by lead selection and optimization, culminating in pre-clinical or clinical testing. Conversely, phenotypic screening generates a hit based on a given phenotype, with the challenge being to identify the target. This process can complicate lead selection, necessitating improved frameworks to render phenotypic screening as structured as target-based programs:

- Developing in vitro models relevant to a wider array of diseases. Patient-derived cell lines represent progress but may introduce unexpected variability in assay conditions. Co-culturing is another promising approach, though it can impact throughput.

- Designing more intricate assays while identifying critical variables that influence reproducibility and disease relevance.

- Implementing a "chain of translatability" concept from biopharma, linking assay endpoints to clinical outcomes.

What additional tools are essential for advancing phenotypic screening?

- Enhancing throughput for more complex models, such as organ-on-a-chip and organoids.

- Translational efforts to construct models for diseases with recent breakthroughs in their mechanisms of action and genetic drivers, particularly in the CNS. Notably, phenotypic screening is poised to significantly impact longevity drug development.

- Developing more accessible proteomic tools, particularly for activity-based profiling during the target deconvolution phase. This would streamline processes and lower entry barriers for utilizing phenotypic screening, as this step is often the most challenging.

- Increasing case studies and efforts to merge phenotypic and target-based screening. The goal is to establish a database that enables phenotypic matching from a virtual screen in the future.

Industrial Enzymes

Enzymes serve as the catalysts for vital cellular processes and play a critical role in industrial biotechnology. The underlying principle is to streamline supply chains using biological processes, with enzymes uniquely suited for this task. They facilitate essential chemical reactions to generate various products, ranging from detergents to specialty chemicals. The field has evolved through four primary eras:

- Enzymes sourced from animals (early 1900s).

- Enzymes derived from microbial sources (mid-1900s).

- Enzymes produced through genetic engineering (1980s to present, with Novozymes leading the charge).

- Enzymes developed via software solutions (current era, with Aperiam Bio at the forefront).

The industrial enzyme market began to thrive in the 1960s, with pioneers like Novozymes, which started operations in the 1940s. The 1980s marked a pivotal period during the biotechnology revolution, as companies like Genentech, Genencor (now part of DuPont), and Novozymes harnessed cloning and genetic engineering techniques to generate enzymes with greater yields and novel functionalities. Genencor, in particular, made significant strides in creating enzymes for products like Tide and ethanol. The key to this growth was the use of bacterial or fungal hosts and deep-tank, fed-batch aerobic fermentation, presenting opportunities to explore diverse hosts tailored to specific challenges. Colorado Biofactory is leading the way in this exploration.

With applications spanning food production, plastics, energy, and textiles, the enzyme market is valued in the billions. A central theme in the enzyme field is the transition from organic chemistry. Traditional organic synthesis often results in environmentally harmful byproducts, yet follows logical steps to achieve target molecules. In contrast, enzymes facilitate natural reactions or products but remain insufficiently characterized to significantly replace organic chemistry. This presents an opportunity to explore the vast array of enzymes and their catalytic reactions, mapping out specificity, catalytic rates, and activity. Establishing a comprehensive database of millions of enzymes alongside these characteristics could establish a new standard, enabling logical pathways for using enzymatic reactions to synthesize target compounds.

Integrating engineering principles is a critical driver for advancement. Employing synthetic biology and innovative tools can create extensive libraries of enzymes and identify functional variants. Key themes include:

- Standardizing components to make screening and discovery reproducible and scalable.

- Linking screening to the synthesis and assembly of DNA.

- Creating modular components applicable across various chassis.

- Enhancing predictability of outcomes—more data allows the discovery of functional combinations.

These principles foster a tight feedback loop between new models and biological experiments, enabling novel predictions. As experiments accumulate, companies can develop a comprehensive knowledge base detailing ineffective experiments, narrowing the search for valuable enzymes with unique functionalities.

Successful case studies like Novozymes, Solugen, and Genencor began with manageable problems and gradually expanded their capabilities to tackle more complex challenges. Emerging companies like BluumBio and Rubi Laboratories are worth monitoring. Generally, the applications for industrial enzymes encompass drug development, consumer products, and broader industrial uses. Software-driven advancements in genomics can unlock new enzymes through enhanced biosynthetic cluster discovery and facilitate the development of enzymes that catalyze complex chemistries (e.g., C-C bonds), ultimately benefiting patients and the environment.

Chemokines

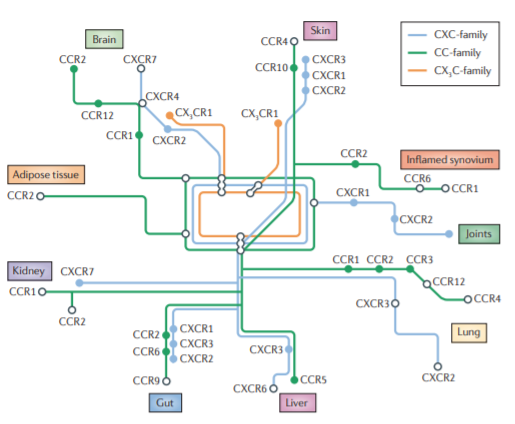

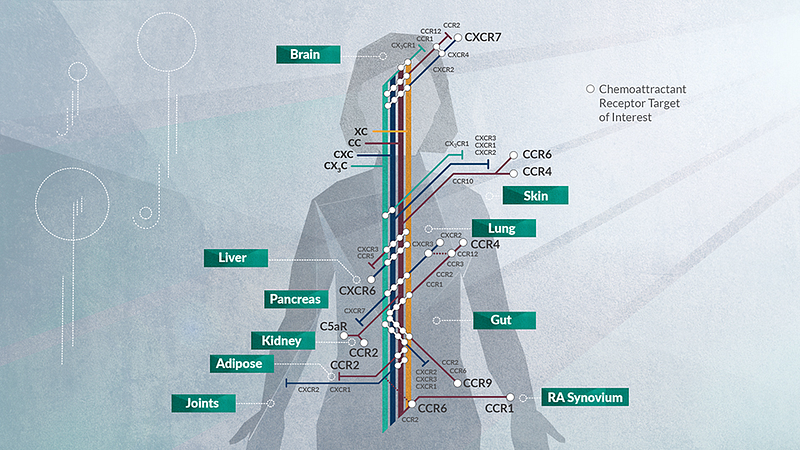

Chemokines play a pivotal role in regulating immune cell trafficking, functioning as signposts to direct immune cells to specific organs. With over 50 chemokines and 20 receptors (GPCRs), they constitute a cytokine class that induces chemotaxis in nearby cells.

The first chemokine, CXCL8 (IL-8), was cloned in 1987 to investigate factors monocytes secrete to attract neutrophils. This spurred extensive research efforts in cloning chemokines and their receptors throughout the late 1980s and 1990s, leading to drug approvals targeting CXCR4 and CCR5 for HIV treatment and C5aR for ANCA-Associated Vasculitis (AAV). Despite the wealth of new drug targets for inflammatory diseases derived from this research, challenges related to dosing and target selection have hindered the development of successful chemokine-targeted medications.

Consequently, substantial opportunities exist to create new therapeutics targeting the chemotactic system, including: (1) small molecules and antibodies that selectively target chemokines and their receptors, and (2) engineered chemokines:

- In autoimmune conditions, chemokines guide immune cells toward self-tissue.

- Pathogens exploit chemokines to evade the immune response.

- Chemokines can enhance vaccine responses.

- They drive inflammatory diseases such as AAV, diabetic nephropathy (DN), inflammatory bowel disease (IBD; targeting CCR9), and rheumatoid arthritis (RA; CCR1).

- Chemokines also influence angiogenesis in cancer.

- Furthermore, conditions like Type 2 diabetes (T2D; CCR2) and chronic kidney disease (CKD) are driven by inflammation in which chemokines are significantly involved.

The intricate orchestration of chemokines and their receptor interactions poses a challenge for drug development. Both the target and the timing of intervention are crucial factors. Emerging opportunities with chemokines focus on target selection for specific diseases, chemistry, and in vivo dosing:

- Mapping in vivo interactions—systematically determining which chemokines bind specific receptors at various doses and locations.

- Understanding the biological responses for each chemokine/receptor pairing, as different chemokines may have multiple functions based on tissue, timing, and pairing. Notably, a small subset of cells with activated chemokine receptors can trigger a widespread immune response.

- Identifying immune cell subsets that respond to specific chemokines; for instance, CCR2 marks an inflammatory class in monocytes, while CX3CR1 indicates a resident subset.

- Dosing considerations—determining in vivo dosing is still predominantly done in vitro. Achieving a therapeutic effect often necessitates continuous inhibition of a substantial proportion of chemokine receptors, leading to potential ADMET challenges.

- Selecting targets—assessing whether a chemokine is redundant for a specific disease, as exemplified by CCR7, which is activated by both CCL21 and CCL19. CCL5 activates three chemokine receptors: CCR1, CCR3, and CCR5, and receptor internalization varies with each interaction. Chemokines have been perceived as a challenging class of drug targets due to this potential redundancy.

Developing antibodies and engineered chemokines—targeting specific chemokines or receptors—requires knowledge of ligand concentrations in vivo. Additionally, drugging the receptors can be complex, given their GPCR nature and multiple transmembrane regions.

In summary, significant potential exists to introduce new chemokine-based therapeutics for patients. The initial step involves creating models and tools to predict which chemokine/receptor pair is implicated in specific diseases and developing drug candidates to target those pairs. The challenge lies in determining which aspects of the control system should be inhibited or augmented.

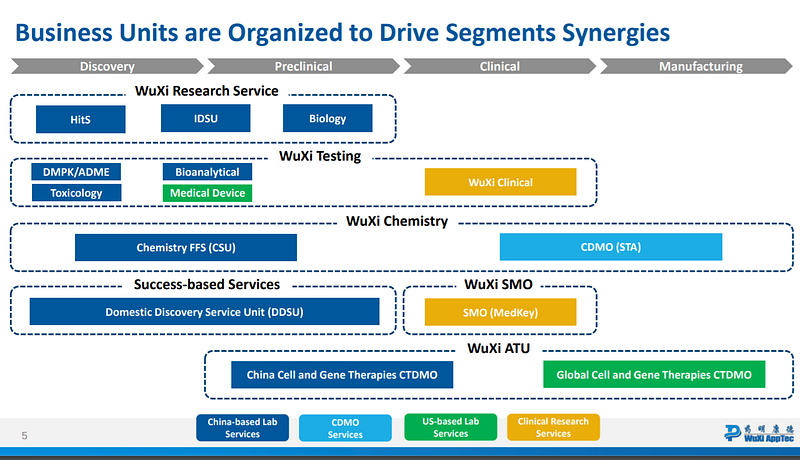

Building the US-Version of WuXi

In light of the push for onshoring biomanufacturing, establishing a US counterpart to WuXi is essential. While Resilience has made strides, many more companies are needed to capitalize on this opportunity and reinvent the contract research organization (CRO) model. WuXi, founded by Ge Li in 2000 as a synthetic chemistry services provider, has consistently introduced new offerings each year—spanning manufacturing, bioanalysis, formulation, and AMDET. Charles River Laboratories had the chance to acquire WuXi in 2010 but declined the offer. Over the last decade, WuXi has grown into one of the largest and most innovative CROs globally, positioning itself to lead discovery services.

WuXi's success can be attributed to six key factors:

- Labor arbitrage—operating in China grants WuXi access to a skilled workforce at significantly lower costs.

- Scale—WuXi has developed a comprehensive suite of services over two decades, catering to a diverse range of modalities from small molecules to biologics and cell/gene therapies. They offer discovery, development, manufacturing services, and even medical device testing and genomics products.

- Flexible deal structures—WuXi accommodates customers with flexible terms, offering fee-for-service contracts with various milestones and royalties on select products. Beyond services, WuXi actively engages in joint ventures and investments.

- Founder-led vision—Ge Li remains at the helm, driven to realize his vision for the company.

- Regulatory environment—companies outside of China aiming to introduce drugs, particularly biologics, must comply with local regulatory requirements, often necessitating the repetition of development and manufacturing processes within China. This creates lucrative business opportunities for WuXi.

- Standardization—WuXi establishes customer loyalty through early engagement and comprehensive integration from discovery to manufacturing.

These six drivers have enabled WuXi to dominate the spectrum from discovery to development and ultimately manufacturing. WuXi has now shifted its focus toward internal product development, exemplified by the 2015 spin-off of its biologics manufacturing business into WuXi Biologics. This transition offers insights into WuXi's future endeavors in cell and gene therapies and beyond. WuXi Biologics emphasizes fully integrated services for biologics drug development: (1) drug discovery, (2) pre-clinical work, (3) phase 1/2 clinical development, (4) pivotal study services, and (5) commercial manufacturing. This end-to-end platform allows clients to engage with WuXi seamlessly, making biologics development significantly more accessible. WuXi Biologics values early partnerships, as customers typically allocate increasing funds as research and trials progress. Due to its critical role for both resource-limited startups and larger firms seeking access to the Chinese market, WuXi has secured royalties on some products developed through its services, positioning itself to build an internal pipeline.

It is evident that WuXi has the potential to dominate the global CRO market. Given its stronghold, establishing a US counterpart is imperative. The end goal is clear—it mirrors WuXi's model. However, initial steps to achieve this include:

- Prioritizing high-value products like cell and gene therapies.

- Developing technology-driven services capable of countering WuXi’s labor cost advantages.

- Consolidating services to create a fully integrated model for a specific region or domain before expanding further.

Infectious Disease

The demand for new medicines and vaccines targeting infectious diseases remains high, yet the business environment for this field has historically been underappreciated over recent decades. The COVID-19 pandemic has underscored the necessity for sustainable business models in this area, particularly concerning multidrug-resistant bacteria, neglected tropical diseases (NTDs), and communicable illnesses in developing countries. The hope is that increased attention and capital will flow into these sectors in the coming years.

However, creating a business focused on developing new antibiotics and treatments for infectious diseases is currently undervalued. The concept of pandemic preparedness gained little traction until the onset of COVID-19. Additionally, global public health is vital for saving lives and is a prerequisite for economic growth, yet most companies lack a global health mandate. To explore the potential for building a substantial infectious disease business, we can examine successful case studies from the field: Gilead, Moderna, Vir, Regeneron, AbCellera, Distributed Bio, Novavax, and BioNTech.

Gilead, founded in 1987 by Michael Riordan, aimed to combat viral diseases. Riordan's experiences in East Asia, where he encountered the inadequacies of healthcare systems while working at a malnutrition clinic and contracting dengue fever, motivated him to pursue medical and business education at Johns Hopkins and Harvard. After a brief tenure in venture capital, he established Oligogen to utilize antisense DNA technology to selectively target viruses, later rebranding as Gilead after the Balm of Gilead, a historically significant medicinal product.

The company's inception coincided with the HIV epidemic, with AZT receiving FDA approval for AIDS treatment in the same year. This urgency propelled Gilead and other infectious disease firms to develop novel therapies. Gilead's successful timing likely played a significant role in its achievements—an acute need for antiviral medications catalyzed its progress.

Early on, Gilead secured an $8 million deal with Glaxo to leverage their antisense technology for cancer treatment, providing the necessary capital to broaden its research scope. This funding was critical for supporting Antonin Holy’s lab, which ultimately led to Gilead's first FDA-approved drug, Vistide, for cytomegalovirus (CMV) retinitis in AIDS patients in 1996. Gilead continued to introduce new approved therapies, such as Truvada for HIV, largely benefiting from advancements in the Holy Lab, which helped transform HIV/AIDS into a manageable condition for many patients.

Gilead's acquisition of Pharmasset for approximately $11 billion in 2011 granted the company rights to two groundbreaking Hepatitis C therapies, Sovaldi and Harvoni, effectively curing the disease. This acquisition marked a pivotal moment in the biotechnology sector, reflecting significant capital deployment and returns over the last decade, representing an unprecedented size for such acquisitions since the early 2000s.

Vir Biotechnology, founded in 2016, assembled a stellar team to program the human immune system to combat infectious diseases. Its broad business model encompasses various modalities, including antibodies, siRNAs, and in-licensing assets, establishing an internal pipeline while funding academic laboratories. While still in its early stages compared to Gilead, Vir has played a significant role in responding to the COVID-19 pandemic, emphasizing its immune system-centric approach rather than targeting specific pathogens.

Moderna has been instrumental during the pandemic, with its recent vaccine approval—along with BioNTech/Pfizer—representing a significant breakthrough for both patients and society. This success validates their strategy of employing mRNA drugs for infectious diseases and beyond. The technology has shown considerable promise over the past 7–8 years, and COVID-19 has expedited advancements that would have typically taken years to realize.

BioNTech mirrors Moderna's approach, similarly positioned to deliver mRNA therapies to a broader patient population, while also integrating other modalities akin to Vir.

Established in 1987, Novavax has focused on developing vaccines for infectious diseases. With no approved therapies to its name over its long history, Novavax has relied on its platform and funding from foundations and public institutions (e.g., BARDA and the Bill & Melinda Gates Foundation) to remain operational. The foundation of their platform revolves around recombinant nanoparticles and Matrix-M adjuvant technology, designed to elicit robust immune responses. However, the data from Moderna and BioNTech's COVID-19 vaccines may render Novavax's efforts less relevant in this context. Nevertheless, Novavax is actively working on vaccines for respiratory syncytial virus (RSV), seasonal influenza, pandemic influenza (H1N1, H5N1), and Ebola virus, among others, with the potential to update its COVID-19 vaccine every few years based on evolving strains.

Companies like Regeneron, AbCellera, and Distributed Bio (now part of CRL) are concentrating on antibody development. Their flexible business models allow for licensing assets in various disease areas while enabling investment in their underlying technologies. This adaptability has empowered these three companies to respond swiftly to the COVID-19 crisis.

Addressing infectious diseases necessitates a robust public health framework beyond mere drug development. Access to clean water, improved nutrition, and maternal/reproductive health is paramount. How can we enhance accountability and prevent decision-makers from neglecting public health without facing consequences? Public health initiatives—vaccination campaigns, waste management, sanitation, and more—significantly influence economic growth, lifespan, and overall well-being. Research indicates that a 10% improvement in life expectancy correlates with a 0.3–0.4 percentage point increase in economic growth annually.

The question arises: Can a sustainable and extensive infectious disease business be established without substantial government support, or is government backing indispensable? Examining the case studies suggests a strong inclination toward the latter. How can life sciences companies align with public health objectives? Is it feasible to create a reward system that encourages entrepreneurs and companies to combat diseases like malaria? Can we implement similar initiatives for rapid infectious disease diagnostics? What challenges remain insurmountable and fall within the realm of nonprofits? Is it possible to devise a universal vaccine?

Key lessons learned include:

- Timing has been crucial. The HIV/AIDS crisis significantly propelled Gilead and Novavax, while the COVID-19 pandemic similarly benefited BioNTech and Moderna.

- Platforms are vital for addressing other health conditions, such as cardiovascular disease and cancer, enabling companies to attract capital for technology investment and capabilities in infectious diseases. Historically, capital has often been scarce for standalone infectious disease companies, with Vir being a notable exception due to its team.

- A focus on human immunology rather than specific pathogens offers advantages, as evidenced by Moderna and BioNTech's responses to COVID-19. This approach enables faster reactions and broader scopes of impact. Inflammatix is leading the charge in diagnostics within this paradigm.

- Opportunities abound for connecting drug development with public health initiatives. Beyond COVID-19, similar potential exists in addressing NTDs and malaria.

- Each case study, excluding Novavax, has implemented some variant of the Merck model: prioritizing high-value indications to subsidize socially impactful programs. For instance, in 1987, Merck distributed its river blindness medication for free, a move made possible by its earlier approval of Mevacor, the first statin.

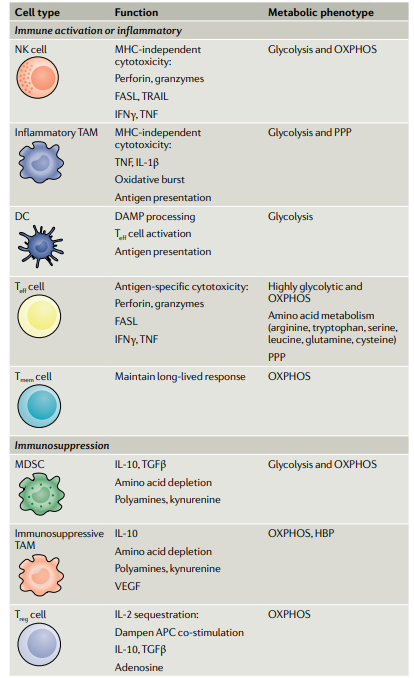

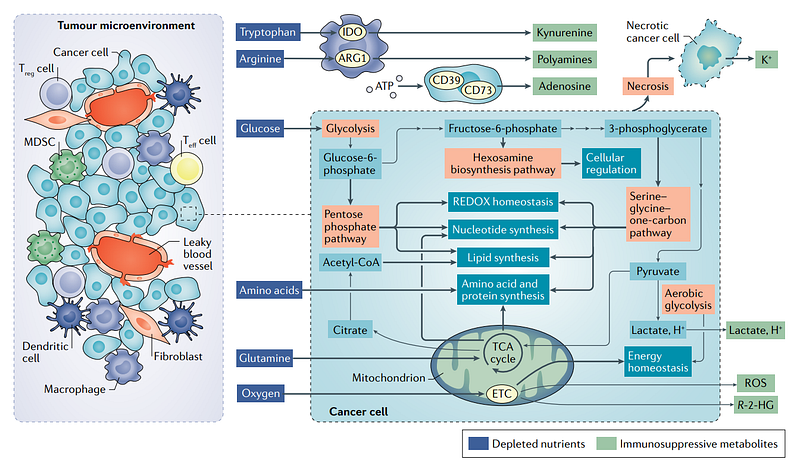

Immunometabolism

Metabolism generates diverse tumor microenvironments (TMEs) across various cancers and patients. Notably, metabolic activities within each TME significantly influence immune cell function and the effectiveness of immunotherapies and cell therapies in treating solid tumors. Immune and cancer cells often compete for the same resources, creating environments that inhibit immune responses but also present opportunities to target metabolism to enhance immune-mediated tumor cell destruction.

Companies like Agios (which initially targeted IDH but has since divested its immunometabolism assets to focus on PKA) are founded on the principle of leveraging metabolism to treat cancer. However, the field's full potential remains to be realized due to the complexity and diversity of immune cell populations within TMEs, along with the intricate roles of oxidative phosphorylation, glycolysis, and other metabolic pathways in immunometabolism.

Immunometabolism is a complex arena. Navigating immunology is already challenging, and incorporating metabolism complicates the understanding of cause-and-effect relationships. Opportunities within this field include:

- Measuring metabolic discrepancies between tumor cells and immune cells within the TME.

- Evaluating the metabolic demands of individual immune effector cells.

- Utilizing this knowledge to identify metabolic vulnerabilities for new drug development. However, slight differences may yield narrow therapeutic windows.

Fast Following in Drug Development

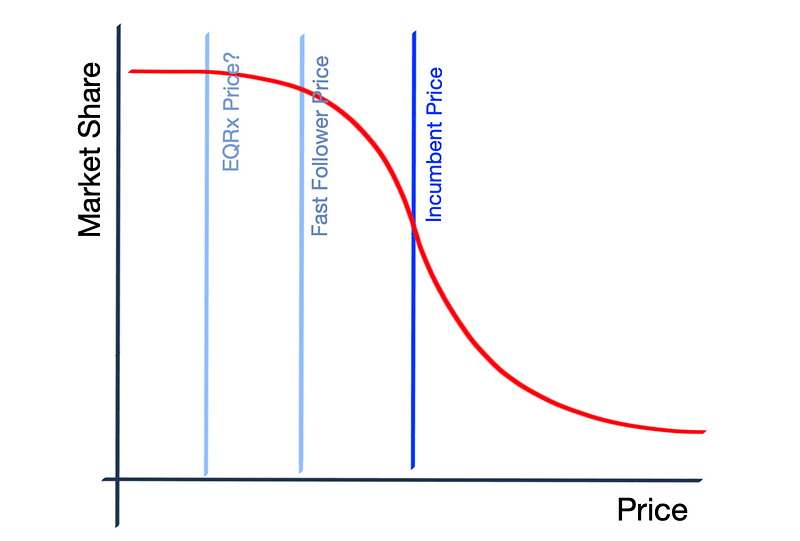

There exists a considerable opportunity to establish new business models focused on rapid following in drug development. Many branded drugs consistently see price increases (exceeding 10% annually) throughout their patent exclusivity, often without corresponding improvements. This dynamic creates a market opening for other companies to swiftly follow branded drugs and undercut prices by as much as 50%. Many biotechnology firms in China and EQRx are at the forefront of this movement. EQRx has recently reported progress on an anti-PD-L1 antibody licensed from CStone in China, showcasing the viability of this business model. The aim is to apply a business model akin to Southwest Airlines or Danaher to drug development. Chinese companies have effectively executed this model within their home market, leveraging labor advantages, larger patient pools, and streamlined regulatory processes. EQRx has boldly initiated a similar approach in the US, adopting a more systematic fast-following strategy.

To succeed in building a sustainable fast-follower business, several factors must be considered:

- The capability to design or discover patent-expiring drugs.

- The ability to conduct more efficient clinical trials. A fast follower must reach the market before a branded drug becomes generic, necessitating the initiation of programs prior to the approval of the branded drug. This requires robust forecasting tools to predict both the success of their drug and the branded drug in trials.

- Focusing on established targets and mechanisms to minimize clinical failure risks. This is facilitated by the increased capabilities of genomics over the last 2–3 decades, which have largely commoditized target discovery.

- Identifying markets where the fast follower model can either expand the market or capture a larger share. A lower-priced fast follower may increase patient access and affordability, though factors like competition, reimbursement, and market uptake remain crucial.

- Establishing strong relationships with payors to ensure patient access and facilitate swift market acceptance.

Ultimately, this model has the potential to commoditize certain aspects of drug development. In areas with defined targets and mechanisms, companies could fortify their commercialization strategies, capital structures, and forecasting capabilities instead of concentrating solely on discovery. However, this model is fraught with risks. Clinical trial failures are likely—can a company withstand the financial strain? Executing expedited trials is challenging even for established targets. Furthermore, patent disputes may arise from this approach, and established players may respond aggressively—biopharma companies could leverage vouchers to shift the burden of high prices, and pharmacy benefit managers (PBMs) might exclude fast followers from their formularies.

The fast follower has the potential to be one of the first drug companies to genuinely delight its customers. So, who might they be?

- Patients—building a brand around affordability and enhanced access.

- Drug companies—a source of licensing opportunities for fast followers, particularly by bringing assets from China to the US.

- Payors—the most critical relationships for ensuring drug purchases and market access.

- Networks—hospitals, in particular, can streamline patient recruitment and facilitate efficient clinical trials. The recent CMS price transparency rule enacted in 2021 further supports fast followers.

- Physicians—fast followers must demonstrate non-inferiority while countering the extensive sales forces of incumbents, with payor assistance in play.

- PBMs—with the recent consolidation of pharmacy benefit managers, fast followers might explore ways to incentivize or bypass them altogether.

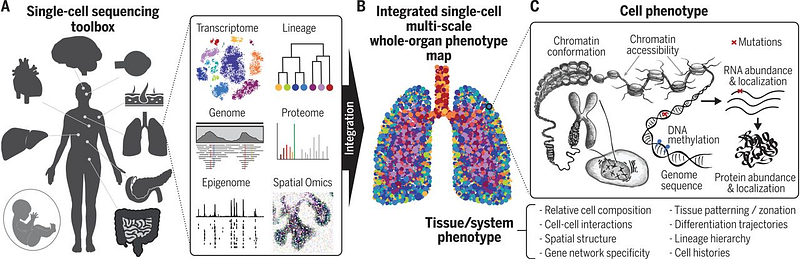

Single-Cell Sequencing

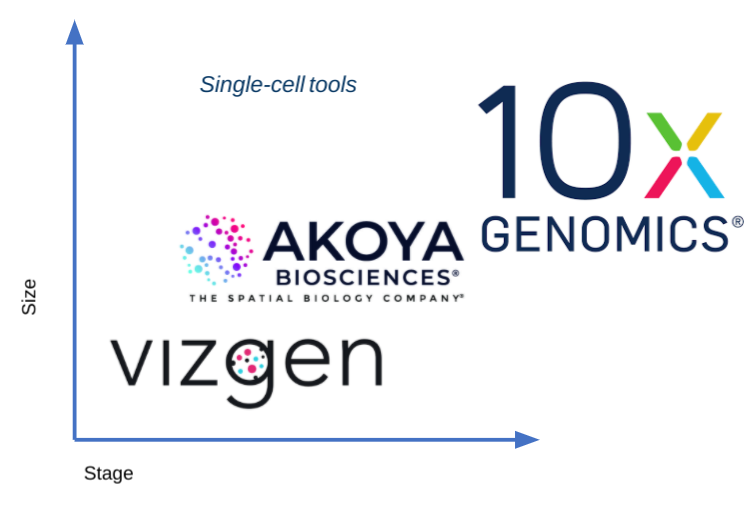

Single-cell sequencing, propelled by innovations from 10X Genomics and Akoya Biosciences, is unlocking myriad research and application avenues in drug development and diagnostics. Researchers can manipulate and profile millions of cells to assess their heterogeneity and individual gene expression. The human genome comprises approximately 30,000 genes, producing over 100,000 mRNAs due to splicing, with each cell expressing around 10,000 genes, often exhibiting cell-specific patterns.

The completion of the Human Genome Project in 2003 catalyzed advancements, particularly in genome-wide association studies (GWAS). The aim was to create a comprehensive database of genetic variants linked to diverse phenotypes and diseases. However, the complexity of biology has hindered GWAS from realizing its full potential. Large-scale sequencing, driven by plummeting costs and advancements from Illumina, has increased data accessibility and expanded the scope of research. The next frontier involves sequencing single cells to explore cell-to-cell variation, transcending human-to-human comparisons, while analyzing their genomes, epigenomes, transcriptomes, and proteomes. New tools are essential for this progress.

Beyond single-cell sequencing, the field is evolving towards perturbing biological systems to evaluate changes within them. A catalog of genetic parts is being assembled, paving the way for large-scale perturbation studies of single cells. Coral Genomics is a leader in this domain, aiming to fulfill the original vision of the Human Genome Project by connecting genetic variants to specific traits and diseases.

What key challenges remain in the realm of single-cell sequencing?

- Integrating new single-cell measurements and establishing standardization across samples: DNA, RNA, proteins, methylation, chromatin accessibility, and spatial arrangements.

- Enhancing sorting throughput and efficiency in single-cell sequencing to achieve substantial gains in resolution and the number of profiled cells. Current limitations may restrict analysis to only a few hundred cells, which could hinder the discovery of diverse cell types and their developmental paths.

- Developing superior analysis and visualization tools to interpret high-dimensional data. The rapid proliferation of sequencing studies has generated immense data volumes, often noisy due to low capture rates, batch effects, and PCR biases. Consequently, more automated tools for annotating cell types are needed.

Single-cell sequencing is constructing a detailed inventory of individual cells. While previous attempts to create a parts list for humans fell short of encapsulating biological complexity, single-cell sequencing marks a significant advancement in understanding biology and disease. For instance, profiling the human kidney, immune cell interactions with antigens, and tumor microenvironments has become increasingly precise due to these methodologies. With improved mechanistic insights, the potential for developing superior medicines and products for human health is promising.

In conclusion, the primary question surrounding single-cell sequencing is: what capabilities do 10X and Akoya enable? 10X dominates the research and development market, while Akoya excels in clinical applications. Both companies hold robust market positions that would be challenging to disrupt. As a result, new companies can explore innovative applications across oncology, autoimmunity, neurodegeneration, and more. New immune cell profiling firms are emerging to identify novel mechanisms in immuno-oncology and autoimmunity. Companies like 23andMe could even integrate single-cell sequencing into their offerings. New diagnostic tools and more accurate organoid models are on the horizon, alongside discoveries stemming from the spatial arrangements within cells—a new frontier in biology. The lessons learned from GWAS emphasize the value of data in generating improved hypotheses. Single-cell sequencing represents a significant leap forward in scale and resolution, empowering innovators and founders to pose better questions to unravel the complexities of biology and disease.