# Crypto Markets Are Experiencing an Unforeseen Surge

Written on

Chapter 1: The Unexpected Resurgence of Crypto

The common refrain from skeptics is that crypto is finished. However, those who lack understanding often overlook that new innovations can seem daunting and suspicious initially. Just as the internet appeared chaotic and untrustworthy in its early days, crypto is undergoing its own period of evolution.

After last year's price declines, I took a step back from discussing cryptocurrencies. Some interpreted this as me losing faith in the sector, but in reality, I was simply tuning out the distractions and waiting for the innovation curve to progress.

As of now, the crypto market is reigniting in ways that few anticipated.

The first video titled "Crypto Markets Are PUMPING!!! (Is Tim Wrong About The FED Decision?)" delves into the current market dynamics and examines whether recent financial decisions are influencing this crypto upswing.

Despite my expectations of a quiet market until next year or beyond, the crypto landscape has surprised many. The sluggish global economy and recent bank failures present systemic risks, and traditional tech stocks remain stagnant. The American S&P 500, akin to a drunken driver struggling to stay on course, reflects this volatility.

Additionally, the geopolitical climate, marked by tensions among economic superpowers and discussions around reducing reliance on the US dollar, adds to the uncertainty. In short, it hasn’t been a favorable environment for financial markets, and typically, crypto mirrors traditional finance trends.

Yet, since the beginning of 2023, Bitcoin has surged by 82.40%, while Ethereum has climbed 66.18%. Such rapid gains are uncommon in traditional investments, which is why crypto is often likened to rocket fuel for investment portfolios.

Section 1.1: Reasons Behind the Market Surge

So, what’s driving this sudden spike in crypto prices?

Subsection 1.1.1: The Psychology of Investment

Investing in crypto is inherently high-risk, and such investments often signal a shift from a bear market to a bull market. The influx of capital into riskier assets reflects a renewed sense of optimism among investors, which is a crucial driver in all financial markets.

With a resurgence of funds flowing into crypto, it’s evident that many investors are regaining confidence in future prospects. If crypto can thrive in challenging economic circumstances, such as Apple's recent report of a 40% drop in Q1 sales, the potential for growth when the economy improves is substantial.

Section 1.2: Economic Factors Influencing Growth

Many analysts believe inflation is beginning to subside, particularly in countries like the United States. Supply chain challenges are being resolved, and the rise of artificial intelligence may usher in a period of deflation, enhancing productivity across the global economy. Experts, including Raoul Pal, predict the onset of a deflationary period.

This shift is significant because high inflation rates previously led to rapid increases in interest rates, which adversely impacted the economy. If deflation becomes pronounced, a reduction in interest rates could follow.

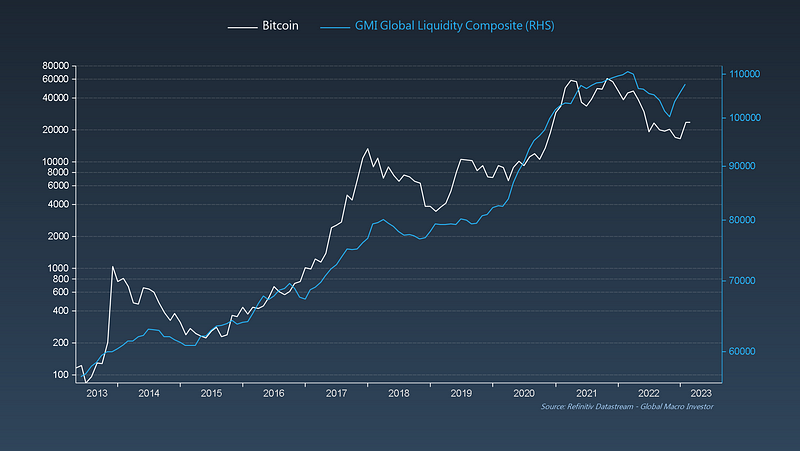

Furthermore, central banks have resumed creating money, a process that, while once shrouded in secrecy, is now widely recognized. When central banks inject liquidity into the markets without corresponding economic productivity, asset prices tend to surge.

The second video titled "Bitcoin Pumped Last Time This Happened!" explores historical patterns in the crypto market, highlighting how past events can influence future price movements.

Section 2: The Future of Crypto

As regulatory frameworks for crypto evolve, especially with potential legalization in regions like Hong Kong, significant price increases could follow.

My crypto-savvy friend DaxxTrader suggests that if Hong Kong embraces crypto, it could act as a catalyst for Bitcoin to reach $48,000. This shift could signal a new era in which the US no longer holds the dominant position in the crypto market, paving the way for broader adoption.

The trend of crypto adoption continues to rise, contrasting with global liquid assets. This suggests that crypto is far from obsolete and is simply following its historical trajectory of growth.

Additionally, major financial institutions like Fidelity, with their $4.5 trillion in assets, have started offering crypto trading to retail investors. Increased participation leads to higher demand, which in turn drives prices upward.

Elon Musk's plans to integrate a digital wallet into his social media platform will grant 500 million more users access to buy crypto, further stimulating market activity.

Ethereum, the second-largest cryptocurrency, has recently undergone a major upgrade known as the Shanghai upgrade. Contrary to doomsayers' predictions of a price decline, the upgrade was successful and resulted in a price increase.